Helping Tradies Avoid Bad Debts, Without The Headache

Worried about customers not paying? One bad debt from a risky customer costs you time and money. Insolvent customers have a big impact on small businesses. Prompt payment is vital to protect cashflow.

The Access Intell software helps you avoid risky customers and protect your business from bad debts. Quick, easy and cost-effective.

As a TradieWives partner, we’ve developed the ultimate guide to credit management specifically for you. An easy, no-nonsense guide on how to protect your business. Learn practical strategies for:

- Bringing on a new customer

- Securing interests (PPSR)

- Monitoring for signs of risk

- Collecting payment

Spotting the signs a customer won't pay

The common red flags – that a customer is likely to pay late or become insolvent – include:

- Loss of building license

- Court actions

- ATO business tax debt default

You need to know straight away, and act quickly to minimise potential financial loss. Our software gathers all this information into one spot and alerts you to red flags.

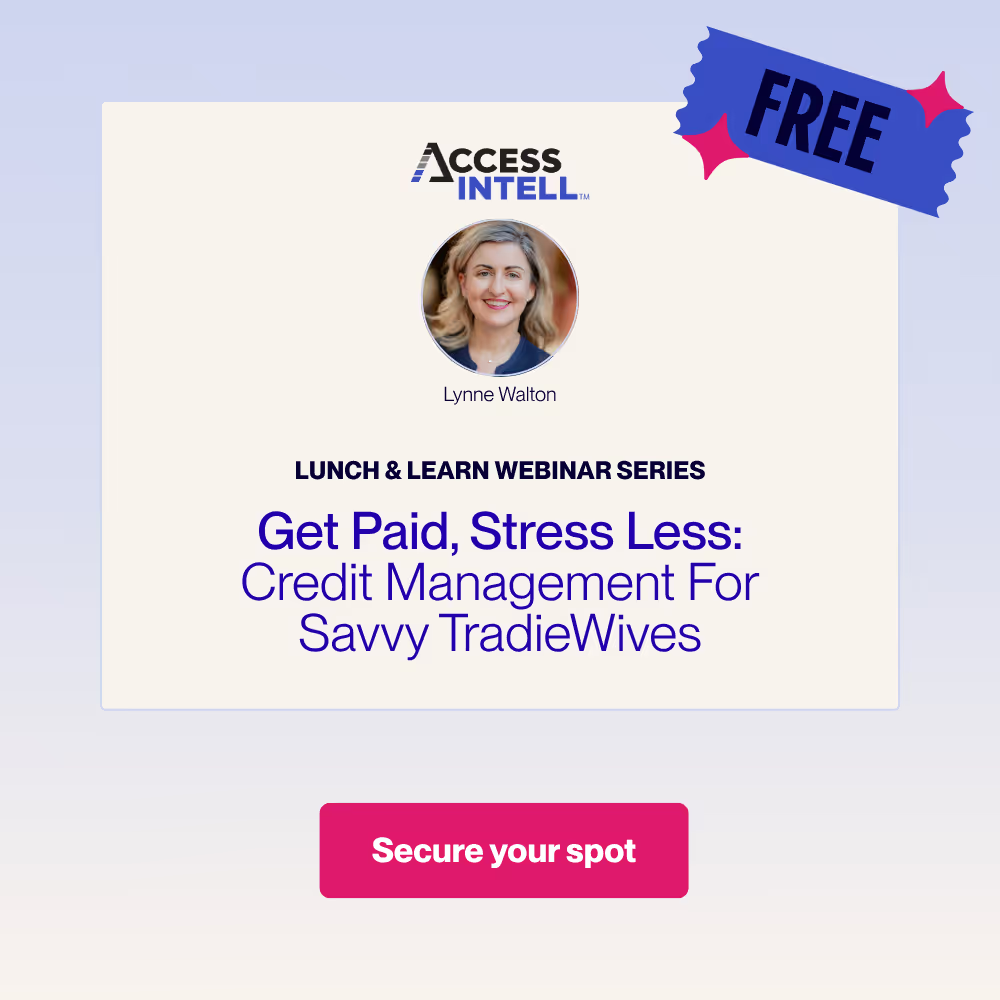

Webinar Series: Get Paid, Stress Less

Join Lynne for a credit management lunch & learn webinar series exclusive for TradieWives. Over four weeks, learn:

1. Dodgy or dependable? Spotting good customers from the start

2. Is PPSR right for you: Your secret weapon to get paid

3. Can they actually pay? The red flags and what to do about them

4. Debt collection processes that get you paid, fast

Register and receive all recordings at the end.

Concerned Your Customer Won't Pay?

Our flexible Pay As You Go (PAYG) monitoring option lets you buy proactive risk monitoring for individual customers for $1/month*.

View data from multiple sources and get notifications on business changes and signs of risk.

Interested? Sign up for a free account to access PAYG monitoring, credit reports, searches and more.

*Billed annually

Our leading-edge products

The Access Intell products create a streamlined credit risk management process from online trade applications and PPSR through to ongoing risk monitoring. Visit our product pages to learn more about their features and view interactive demo's.

New Customer Onboarding

Receive, assess and approve trade credit applications online with Access Approve.

Secure Interests With PPSR

Protect against insolvent customers with Access PPSR’s automated, accurate PPSR registrations.

Proactively manage Credit risk

Access Monitor continuously monitors your customers credit risk with all the information you need in one place.

.avif)

Client testimonials

Our clients say we go above and beyond – hear what they have to say.

Kim Hulme

National Accounts Receivable and Payable Manager, Ausco Modular

Jane Turner

Accounts Receivable, ABC Building Products

Paul Burgess

National Credit Manager, Steelforce Australia

Ready to get started?

Book a tailored demo with our team to learn how Access Intell can help your business make wise credit decisions, manage financial risk, and get paid.