Service Providers

Effective Credit Risk Management Solutions for Service Providers

Leading-edge credit management software for service providers such as lawyers, accountants, bookkeepers, HR recruiters, debt collectors, real estate and more. Manage risk and avoid bad debts for your business and on behalf of your clients. Onboard creditworthy customers, register security on PPSR, monitor for risk and collect invoices.

Make wise credit decisions, manage financial risk, and get paid

Our products create a streamlined process from online trade applications and PPSR through to ongoing risk monitoring. Use the software for your own business or on behalf of your clients. The top features for service providers include performing PPSR searches, managing PPSR registrations and generating credit reports.

Before Access Intell

After Access Intell

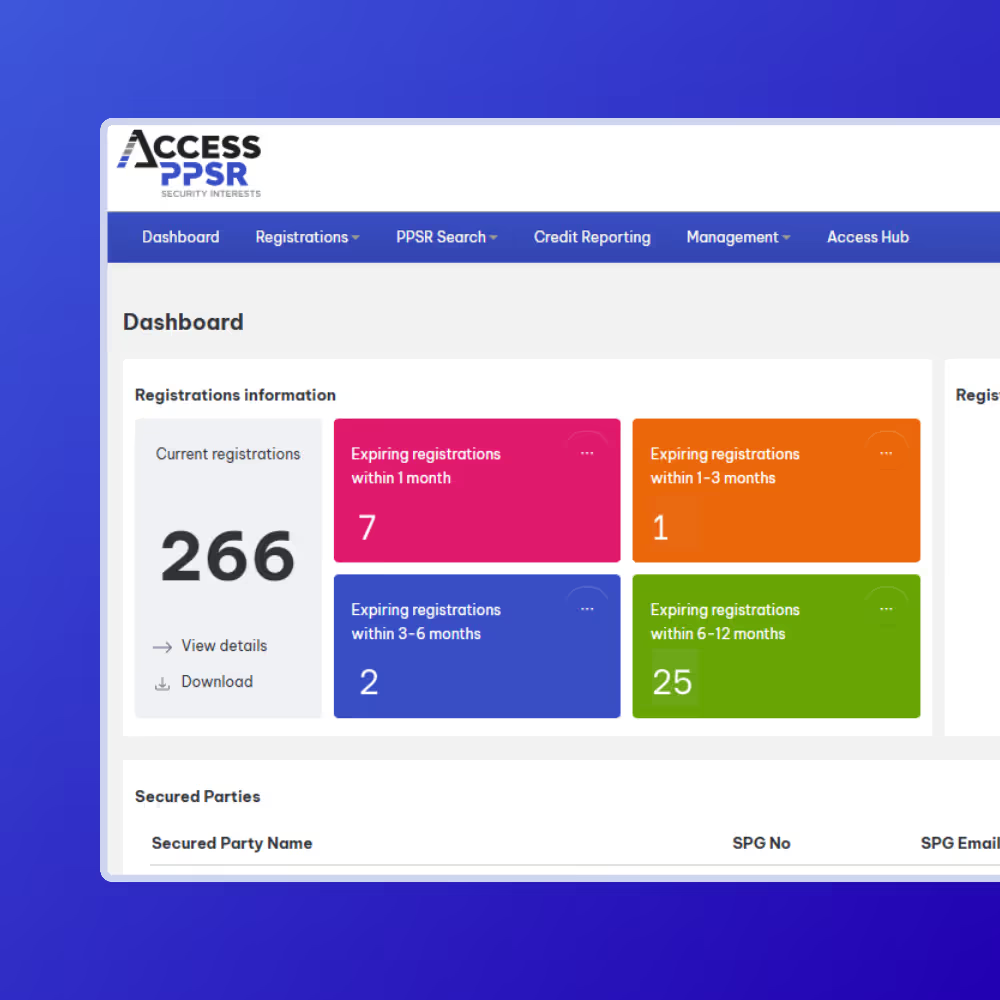

Automated, Accurate Registrations

Our automated PPSR registration processing and management product offers service providers an easy, effective PPSR solution. Pre-set profiles and built-in grantor and asset validation tools ensure registrations are right every time.

PPSR Searches

Quickly and easily order the motor vehicle searches you need, when you need. Save time by completing all your commercial searches in one place, with aggregated data from NEVDIS, PPSR and RedBook.

View our commercial motor vehicle search options.

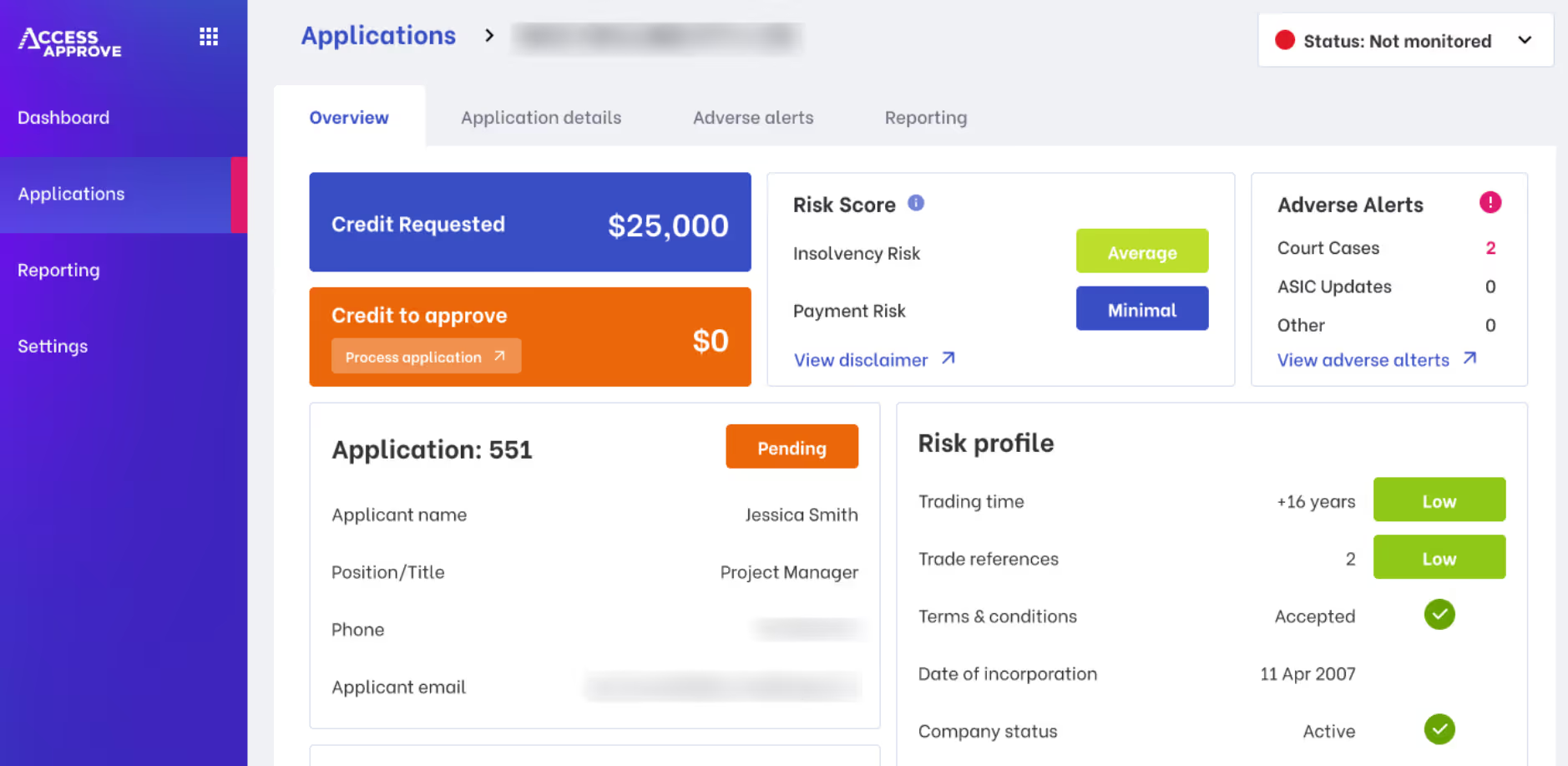

Ongoing customer risk monitoring

Our monitoring product enables service providers to continuously monitor the credit risk of their clients, and their client's customers. Instantly see customer changes and adverse alerts, with all the information you need to proactively make decisions in one place.

We’ll have you onboarded within 24 hours. Our flexible software integrates seamlessly with your unique business structure, processes and needs.

Our leading-edge products

The Access Intell products create a streamlined credit risk management process from online trade applications, PPSR, ongoing risk monitoring through to collections. Visit our product pages to learn more about their features and view interactive demo's.

Onboarding

Our software gives you (and your customers) an efficient, paperless onboarding process. Receive, assess and approve trade credit applications online, seamlessly.

PPSR

Simplify the complexity of PPSR registrations through automation for an efficient, accurate process. In the event of customer insolvency, you're a secured creditor and are first in line for payment.

Monitoring

Continuously monitor the credit risk of your customers and be alerted to red flags for late payments and insolvency. All the information you need to proactively make decisions and manage credit is in one place, saving you time.

.avif)

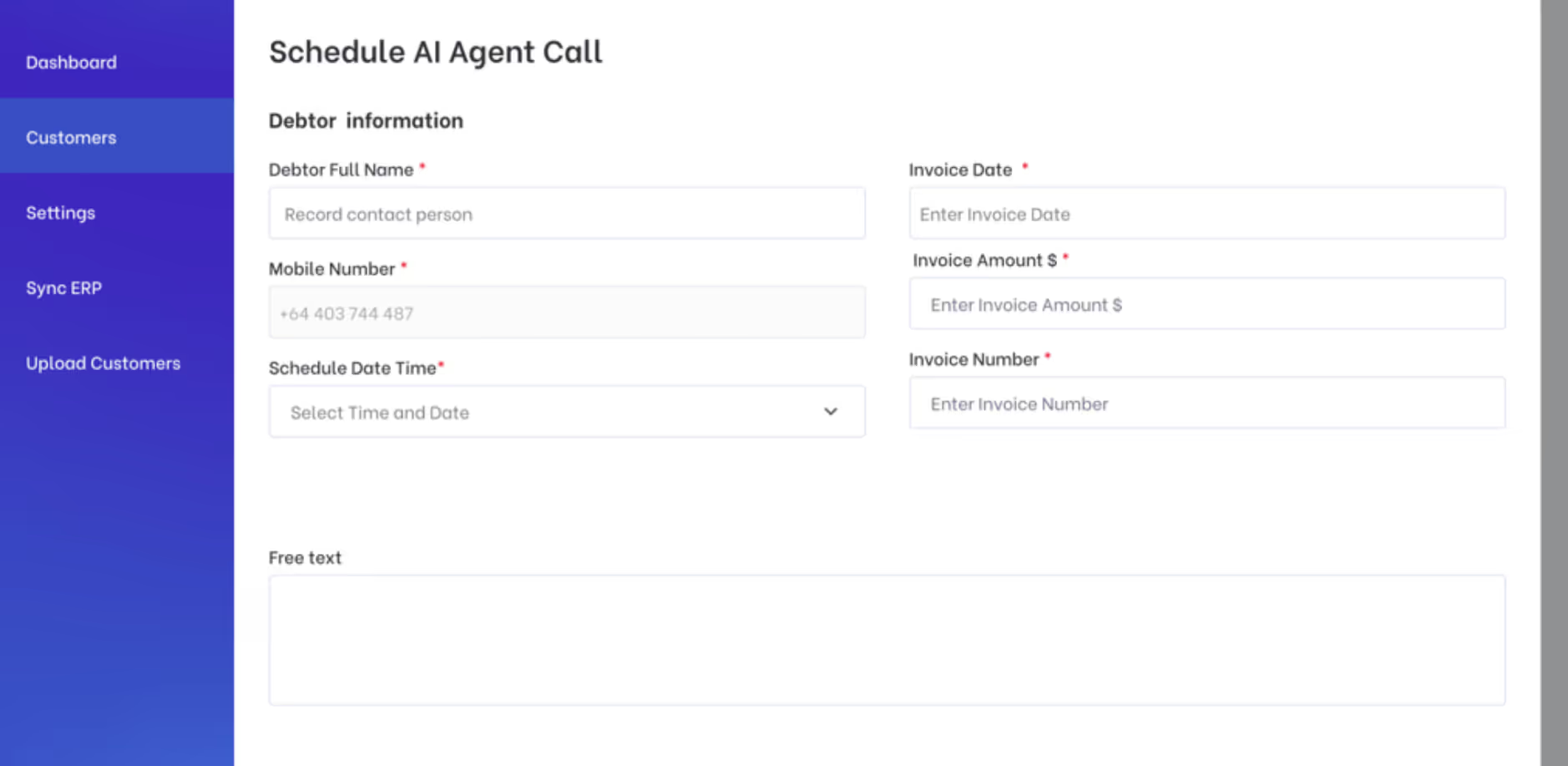

Agentic AI Collection Calls

Automate your accounts receivable calls with AI-Powered invoice reminder and collection calls. The customisable AI Agent completes personalised conversations so you get paid, faster. Human escalation triggers and compliance safeguards ensure an enhanced customer experience.

Case Studies

Learn how service businesses like yours are using our products to make wise decisions and grow sales.

AI helps business collect debts without sacrificing customer relationships

Online Trade Credit Application Speeds Up Customer Onboarding From Days To Hours

Reliance on outdated credit data lost this business $25,000

Client testimonials

Our clients say we go above and beyond – hear what they have to say.

Peter McPhee

Group Credit Manager, Velocity Vehicle Group Australia

Matthew Rouse

Managing Partner Rouse Lawyers

Leon Dodd

General Manager

Ready to Get paid, faster?

Book a meeting with us to have a personalised discussion on how we can add value to your business.