Understanding risks in financial institutions

At its core, credit risk refers to the potential loss a bank might suffer if a borrower defaults on their loan repayments. This risk becomes exceptionally high when the borrower fails to meet the obligations of any financial contract. Credit risk management is crucial in safeguarding banks from such potential losses.

Here are some of the specific risks that financial institutions face today:

- Credit risk: This is the risk that pertains to the possibility that borrowers will default on their loans.

- Market risk: This is the risk that the value of assets will decline. Rising inflation and interest rates increase the risk of market losses.

- Liquidity risk: This is the risk that financial institutions will not be able to meet their obligations when they come due. Rising inflation and interest rates add to the increase of liquidity problems.

While it’s essential for financial institutions to take steps to mitigate these risks, it’s also important to be aware of what they’re facing. Understanding them can make these institutions make informed decisions on minimising credit risks and protecting their clients and portfolio.

The steps include the identification, assessment, measurement, and control of credit risk. Not only are they good practices, but they’re also essential for the longevity and success of financial institutions

Below are a few strategies to mitigate risks in financial institutions.

1. Strengthening credit assessment and approval process

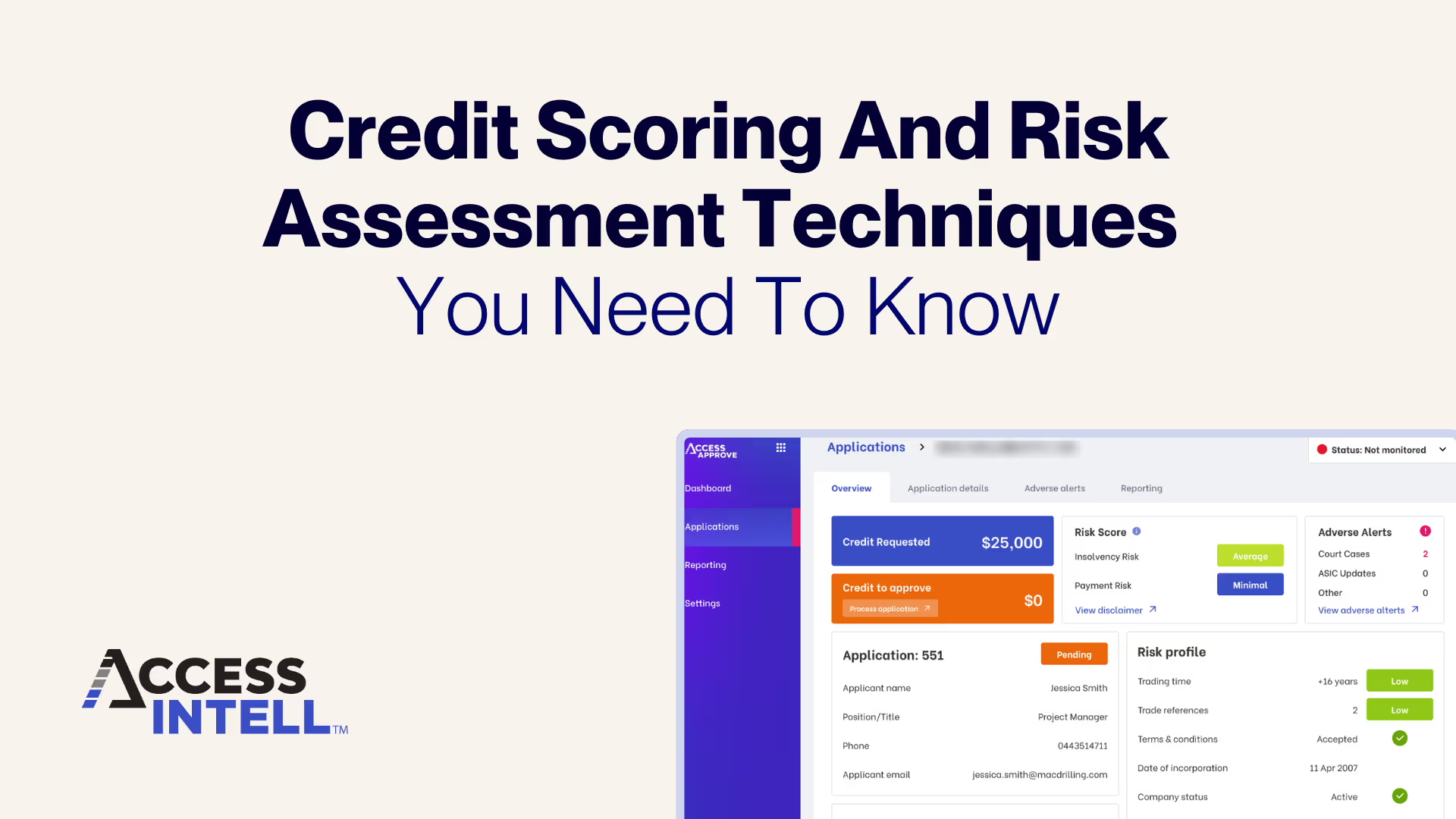

The first strategy that comes to mind when asking ‘How can a bank minimise its credit risk?’ is strengthening the credit assessment and approval process. A rigorous credit vetting process can significantly reduce the chance of default.

Banks do this by considering several factors, including the following:

- Credit report

- Credit score

- Income

- Assets

- Debt-to-income ratio

Based on these factors, financial institutions can make an informed decision about extending or not extending credit to a borrower. Lenders also use the so-called five Cs of credit in evaluating a potential borrower’s creditworthiness:

- Character: The borrower’s trustworthiness, judged by their credit history.

- Capacity: The borrower’s ability to repay the loan, determined by their income and debt.

- Capital: The borrower’s assets or investments that could be used as loan security.

- Collateral: Specific assets pledged by the borrower that the lender can claim if the loan isn’t paid.

- Conditions: How the loan will be used and the effect of current economic conditions on repayment.

Lenders will weigh each of the five Cs differently depending on the type of loan and the borrower’s circumstances.

2. Portfolio diversification

Diversifying the loan portfolio is another essential strategy in credit risk management. By spreading loans across various sectors, banks can mitigate the impact should one sector face financial difficulties. This strategy ensures that the bank’s exposure to any single borrower or sector is limited, reducing the potential risk of significant losses.

3. Adopting advanced analytical and prediction tools

Modern technology has brought about a new era in credit risk management. Predictive analytics and artificial intelligence are changing the way banks manage credit risk. Machine learning models can predict potential defaults with high accuracy, offering valuable insights on how to reduce credit risk.

By using AI to identify early warning signals of potential loan defaults, banks can act proactively and take steps to protect themselves.

4. Regulatory compliance and risk-based supervision

One strategy that cannot be overlooked in credit risk management is regulatory compliance and risk-based supervision. Compliance with regulations such as Basel III ensures that the bank maintains adequate capital levels to withstand financial stress. This requirement, coupled with an efficient supervision system, can significantly help in preventing financial risk.

Basel III was developed after the 2007–2008 financial crisis to fix the shortcomings of previous regulations. It requires banks to hold more high-quality capital and liquid assets and reduces the amount they can borrow. These are measures designed to prevent another financial crisis.

5. Establish a strong Human Resources (HR) foundation

The human element is a vital factor in risk mitigation, but it’s often overlooked. Regular training and development can equip bank staff with the necessary skills to identify and manage potential risks. Also included are the employee handbook and harassment training.

Investment in human capital through training improves risk management and boosts staff morale and confidence.

Key Takeaways

Mitigating risk in financial institutions is a complex process requiring various strategies. From strengthening credit assessment processes to diversifying portfolios, leveraging technology, ensuring regulatory compliance, and investing in continuous training – these strategies collectively contribute to minimising credit risk. Using these strategies, banks and other financial institutions can prepare for any financial risk and maintain long-term stability.