Customer Credit Risk Monitoring: The Ultimate Guide For B2B Finance Teams

A new customer applies for trade credit and is accepted. Great, let the sales flow! But that ‘point in time’ credit assessment shouldn’t stop there. Changes in your customers creditworthiness can create financial risk. Being proactively alerted to those changes ensures you can take action to protect your business. The Access Intell guide to customer credit risk monitoring covers the information you need, how different teams can use it and the benefits of data visualisation. Learn why ATO disclosure of business tax debt default reporting, court actions and multi-bureau data is so important to proactively managing risk. We also compare key features of the Access Intell monitoring software to other providers and manual processes.

TLDR Summary:

Credit risk monitoring is an important tool for finance teams to mitigate financial loss. Being on top of those changes means you can proactively manage your accounts. Depending on risk appetite, it may help you decide whether to offer a cash account rather than extending credit. Using this data proactively can mean the difference between suffering a large bad debt and protecting your business.

What is customer credit risk monitoring?

Credit risk monitoring is the continuous monitoring of customers for changes in financial health that indicate potential risk to your business. It’s an important component of a creditors risk management strategy as it helps to minimise potential financial loss. By proactively monitoring the creditworthiness of customers, businesses who extend trade credit can identify and manage potential risks before financial losses occur.

Some businesses do this manually, which is time consuming and not truly continuous so prone to red flags not being known. Others use monitoring software like Access Intell, which provides 24/7 monitoring alongside email alerts of changes in risk.

What information is needed to monitor risk

Credit monitoring data should include the most diverse information possible to get the full risk picture. Our software aggregates trusted data via complex third-party integrations from a diverse range of financial and government sources. Important red flag alerts we cover include court actions, adjudications, ATO business tax default reporting, license changes, ASIC updates and insolvencies.

The top warning signs a customer is headed toward insolvency

Here are the top indicators to watch for:

- Consistent late payments

- Sudden changes in ordering behaviour

- Difficulty reaching decision-makers

- Negative credit reports or adverse alerts

- A reportable ATO business tax debt default

- Court actions or supplier complaints

Read more about these warning signs, how to spot them early and actionable steps you can take.

Why you need to know ATO Disclosure of Business Debts tax information

The Australian Taxation Office (ATO) Disclosure of Business Debts legislation provides tax default information that is vital to creditworthiness. The ATO may disclose overdue business tax debt to approved credit reporting bureaus (including Access Intell) if a business meets the following criteria:

- The business has an Australian Business Number (ABN) and is not an excluded entity.

- The business has one or more tax debts and at least $100,000 is overdue by more than 90 days.

- The business is not engaging with the ATO to manage their tax debt.

With over 36,000 business tax debts disclosed in the 2023-24 financial year, businesses can’t afford to miss this critical information.

Visibility of overdue tax debts provides an early warning of possible distress in the defaulting customer, allowing businesses to manage their risk exposure and proactively work with affected customers.

Why customer court action data is important to monitor

Certain types of court actions (particularly non-payment of a debt) are indicators of customer financial distress which is vital for suppliers to know. We compile court action data which appears within hours of the action being listed in court. Most providers offer court judgement data which is only available months and sometimes years after the action first appears in court.

How to continuously monitor building and liquor licenses

Monitoring certain business licenses for changes like building licenses and liquor licenses is crucial for credit risk management. If a customer’s license is suspended or cancelled, you need to know straight away to investigate, halt orders if required and manage any debt exposure. The Access Intell monitoring software easily automates this task and instantly alerts you to changes.

How monitoring can be used by multiple team members for different purposes

Each business has its own unique structure, risk profile and customer base. Keeping track of changes to your customers and where your risk lies can be time consuming. Our customer grouping feature gives you the ability to quickly and easily group your customers to view risk the way it works for you. Uses include:

- An entity group allows a CFO to drill down on business risk to the division or entity level.

- A credit manager can group by customer type, such government bodies, private companies, or not-for-profit.

- A credit manager can group by entity structure, e.g. sole traders, trusts, companies.

- Grouping by ease of collection can assist accounts receivable with where to direct efforts.

- Grouping by industry type can quickly identify customers in the highest risk industries.

Using risk assessment to prioritise accounts receivable collections

Knowing which customers to focus accounts receivable collections efforts on is crucial. Traditional prioritisation methods include by balance, payment performance, aging buckets, or days sales outstanding. Prioritising by risk assessment is another targeted strategy option that focuses on the business’s ability to pay. Our monitoring software does the risk assessment for you, placing your customers into risk bucket categories. By filtering your customers by risk bucket category, you receive an instant priority list of which customers to focus your collections effort.

Why businesses should be monitoring their Suppliers too

Supplier risk can be just as damaging as customer risk, sometimes even more so. The financial failure of a key supplier can severely impact your operations, leading to missed deadlines, unhappy customers and lost revenue. Ongoing credit monitoring of suppliers is essential.

The benefits of data visualisation for credit risk management

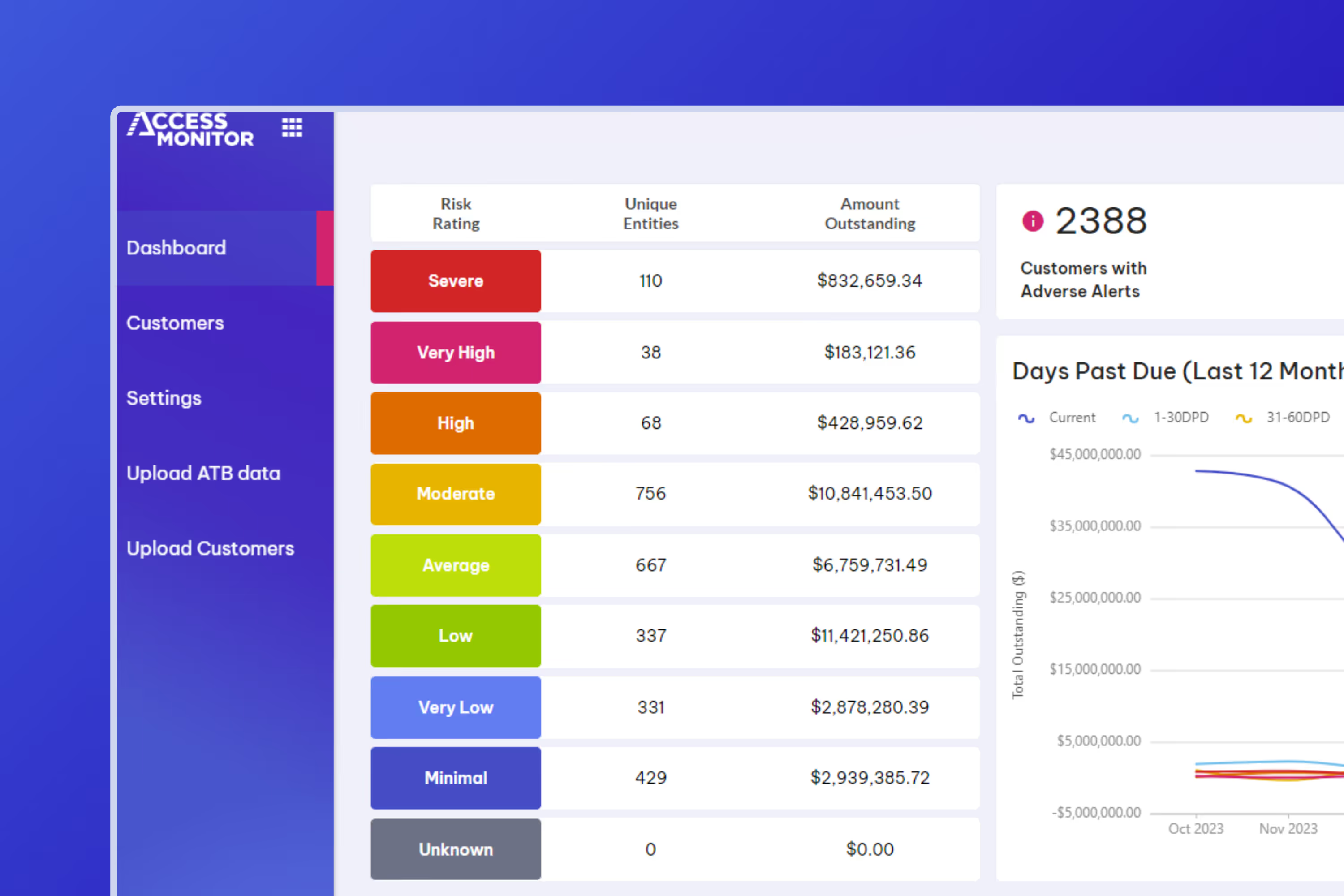

Data visualisation can transform complex credit risk datasets into intuitive, visual formats. It’s a key tool for efficient, effective credit risk management. Our interactive monitoring dashboard (pictured below) places your customers into eight colour-coded categories of overall risk. This snapshot overview instantly shows where the risk lies, including the number of unique entities and the amount outstanding. We use a similar approach for the payment risk and insolvency risk ratings provided for each customer. Colour coding provides the visual representation of risk, and customers can be filtered by these ratings.

Reliance on outdated credit data lost this business $25,000

This business approached Access Intell after losing $25,000 in bad debts to a trade debtor. They had relied on outdated information from a credit bureau. Unbeknownst to them, the debtor had multiple recent defaults listed with another bureau. Learn how we helped them monitor customers for signs of risk with the most complete data picture and timely updates of customer changes.

No, director penalty notices (DPNs) are not publicly available or reportable on credit checks. However, ATO business tax debt default reporting is available through approved bureaus (including Access Intell). An ATO business tax debt default is a leading indicator of a DPN, with DPNs often a trigger for directors to appoint an external administrator to avoid become personally liable for the overdue tax liabilities being pursued by the ATO. Companies subject to ATO reporting have a very high failure rate. Clients that use our onboarding and monitoring products have instant access to this vital information both within the platform and via email alerts.

An insolvency risk score or rating is the probability of the customer becoming insolvency in the coming 12 months.

A risk of late payment score or rating predicts the likelihood of a company paying in a severely delinquent manner in the coming 12 months. Scores are driven by advanced statistical modelling techniques using a variety of data elements including aggregated live payment data from other suppliers.

Different credit bureaus have different data sources, strengths and weaknesses. Relying on one credit bureau for information creates risk that important creditworthiness data will be missed. For example, default data often isn’t shared between bureaus. Choosing the right bureau data and from multiple sources gives you the full risk picture.

Why Use Access Intell?

Ready to help your business grow?

Book a tailored demo with our team to learn how Access Monitor can continuously, proactively monitor your customers credit risk.