The Ultimate Guide To Invoice Collection: How To Get Paid, Fast

The timely collection of payment is vital. Ideally, customers pay unprompted and on time. In reality, there are some simple steps you can take for an easy and efficient collections process. Our guide covers the importance of a formal debt collection process, why strong terms and conditions of trade matter, why polite perseistance wins and seeking help from debt collectors or lawyers.

TLDR Summary:

Debt collection is an inevitable part of extending trade credit. Slow payments, reduced cashflow and high dispute resolution times are the bane of Accounts Receivable teams. It doesn't have to be that way. Read on for practical strategies to help your business get paid, faster.

Why a debt collection process is important

A debt collection process outlines the steps your business takes to collect invoices. It ensures a consistent, repeatable process that is clear for both staff and customers. The process should match your terms and conditions of trade, outlining what will happen if payment isn’t received on time. Importantly, the process needs to be executed automatically upon non-payment. Consider multiple touch methods e.g.:

- Automated reminders at a set time prior to the due date.

- Automated reminders after the due date if payment hasn’t been received.

- Using a mix of emails, text messages and phone calls.

- A clear escalation process at set time periods, including when measures like referral to debt collection or lawyers is appropriate.

Why strong terms and conditions matter for invoice collection

Late payments and disputes often stem from unclear agreements. Strong terms and conditions (T&Cs) are your first line of defence against payment delays and collection headaches.

T&Cs outline the rules of engagement between your business and its clients. They typically include payment terms, payment methods, delivery terms, dispute resolution, interest and fees, help create a security interest and much more.

By setting clear expectations upfront, you reduce risk, improve collections and keep your business financially secure. Ensure you provide your T&Cs to all new customers as part of the onboarding process.

Practical strategies for getting paid

There are a range of strategies available to help ensure invoices get paid:

- Resolve any invoice issues quickly to minimise payment delays.

- Consider offering early payment incentives like discounts.

- Consider working with good customers who are struggling to pay – a payment plan can be a good short-term resolution that builds loyalty.

- Utilise any leverage you might have to negotiate payment e.g. project completion, occupancy certificate, delivery of next order, etc.

Why polite persistence wins in collections

In collection, polite and firm are not opposites. In fact, they’re the secret weapon of every successful accounts receivable team. Too often, businesses assume that being friendly means being lenient. That misconception can cost you time, money, and customer relationships. A professional tone signals respect and reliability, even when enforcing payment terms. When you strike the right balance, customers trust you and pay on time.

How businesses are utilising Agentic AI Collection Calls to get paid faster

Our clients are achieving incredible results from Agentic AI Collection Calls. Collecting debts without sacrificing customer relationships, reducing friction and unlocking significant cash flow.

- $420,000 collected across 1500 invoices in 3 weeks (fresh food supplier)

- 16 invoices collected totalling $47,000 (construction consultant)

- $675,000 collected for 400 invoices in 3 months (service provider)

- 166 invoices totalling $625,000 collected in 8 weeks (construction supplier)

Case Studies: Learn how businesses are using Agentic AI Collection Calls to get paid, faster

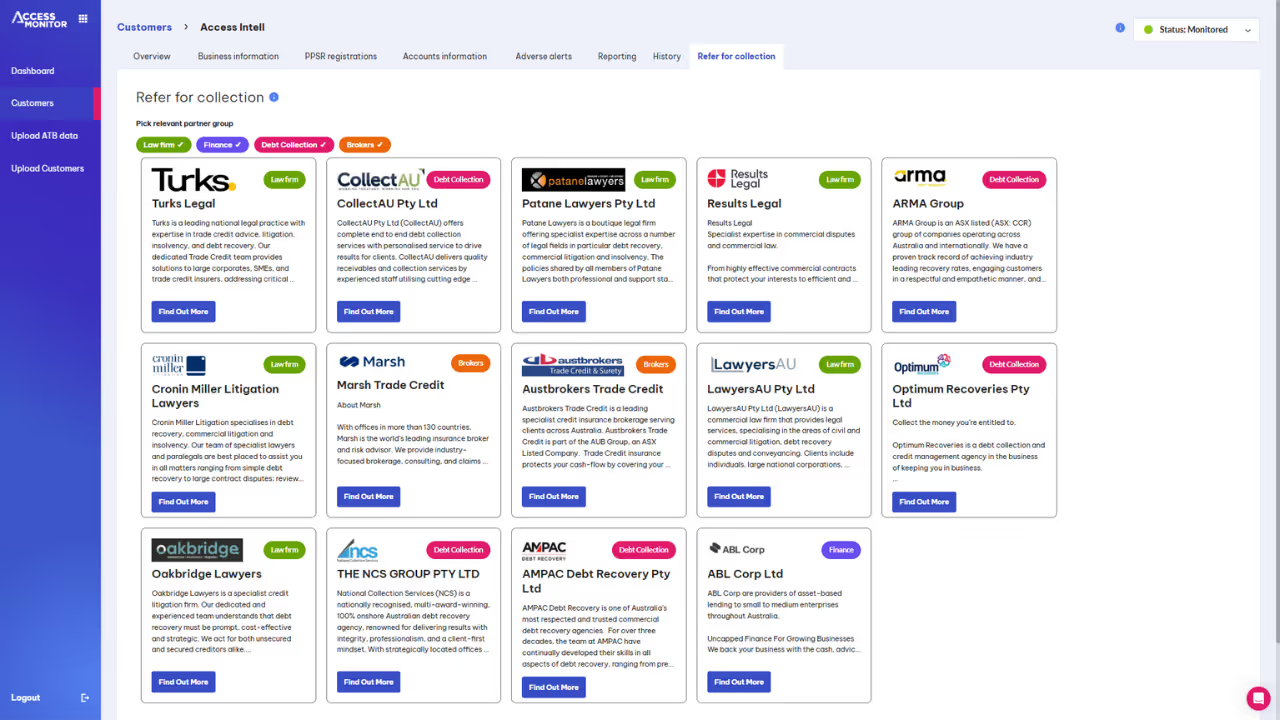

Seeking help from debt collectors or lawyers

Don’t be afraid to seek help from debt collectors or lawyers when needed. Our ‘refer to collections’ feature provides one click referral of debt, instantly bundling up and sending all the required information to trusted partners for action.

Ready to get paid, faster?

Contact us to start automating your invoice reminder and collection calls with AI.